YOU NEED TO KNOW

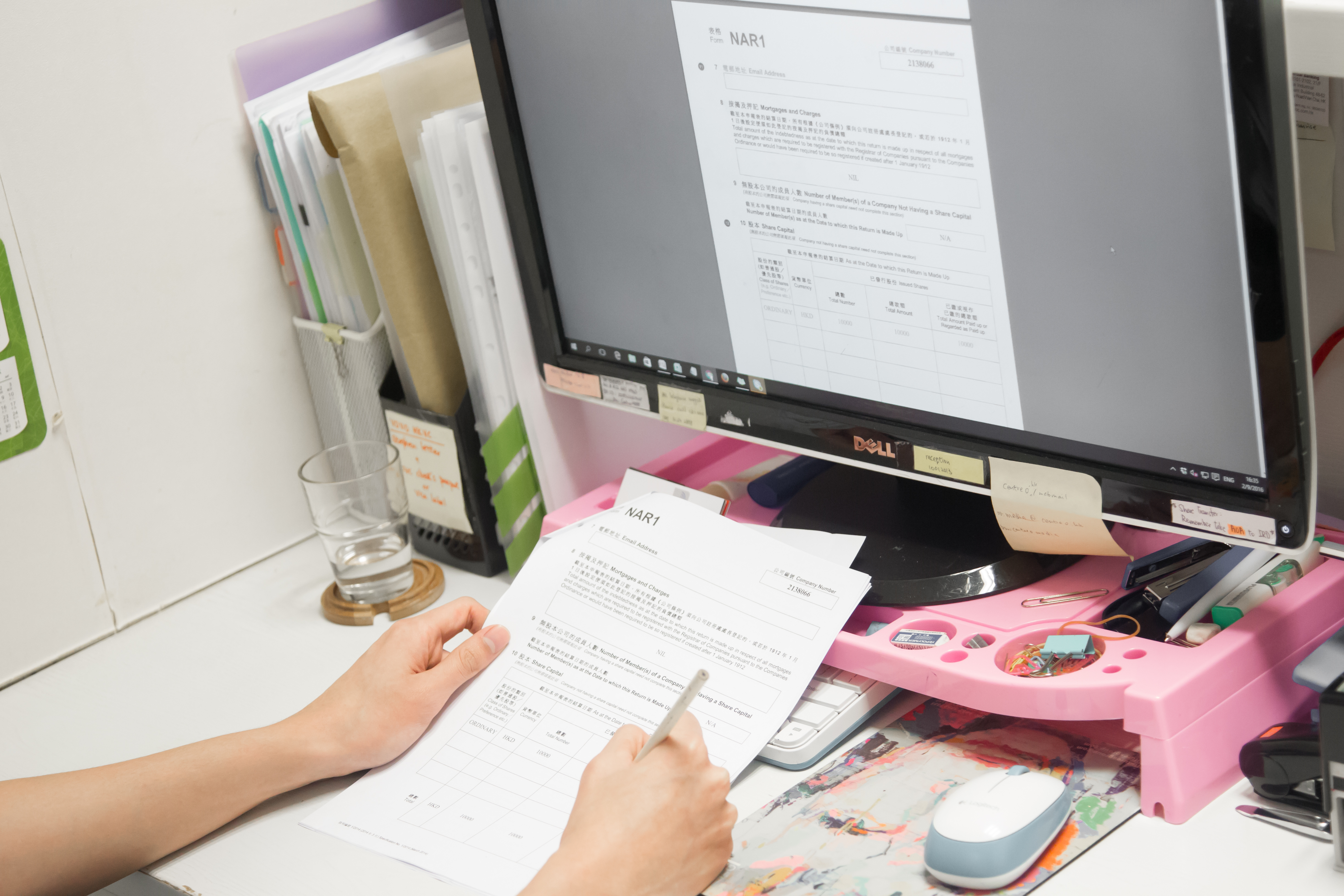

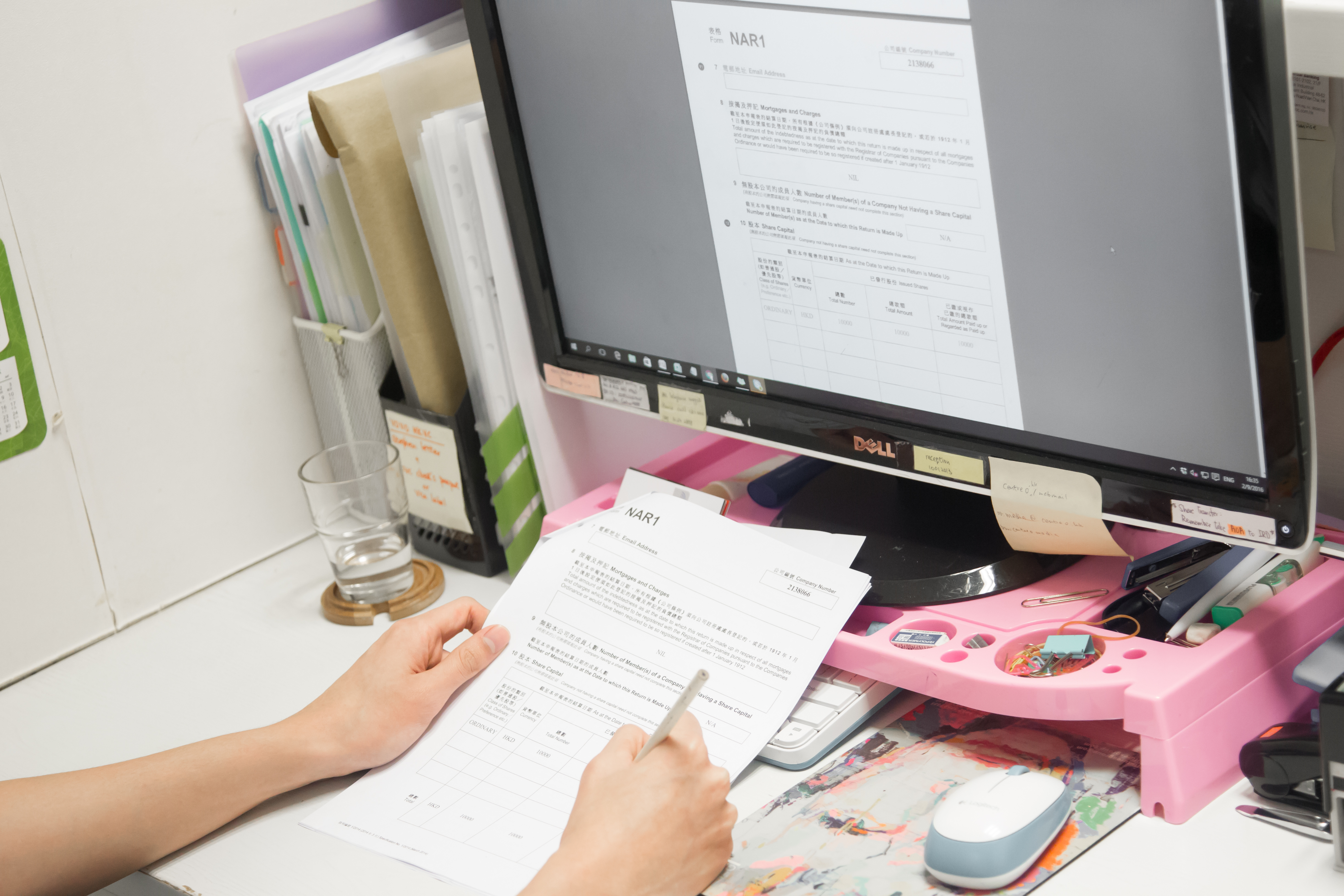

HONG KONG COMPANY BANK ACCOUNT KYC

With the increasingly connected world, financial crime is a growing global issue. The banking institutions will keep updating your company information regularly. The regular checking is called Know-Your-Client, you have to response the KYC properly and in a timely manner. What is KYC? KYC means Know Your Client and sometimes Know Your Customer. This check …

WHAT IS SOURCE OF FUNDS AND SOURCE OF WEALTH?

Financial crime is becoming critical. Entrepreneurs have to protect themselves and their businesses, which are not falling into the crime. Then we have to implement an array of Know Your Customer (KYC) measures. Hence, 2 questions must be asked, which are source of funds and source of wealth. What is Source of Funds (SoF)? SoF …

WHAT IS A BRANDING KIT?

Branding Kit A brand kit is a collection of the visual elements of your brand: the colour palette, logo(s), and typography. It also known as a brand style guide or brand guidelines. It is a document that outlines the visual and stylistic elements of a brand. So branding kit serves as a reference point for …

HONG KONG BANK ACCOUNT OPENING – 4 STEPS ONLINE SETUP

Remote Account Opening If your business is set up in Hong Kong and your wanted to open a business bank account. Then most of the bank can provide remote account opening platform via your mobile phone app. Thus, you can apply anytime, anywhere by using the remote account opening service. Step 1 Visit your preference …

CHINA: TRADEMARK APPLICATION AND APPEAL

China is a “first-to-file” jurisdiction, it means you have to register a trademark in order to obtain proprietary rights. So, if you are planning to start your business in China, Centre O would strongly recommend to register your China trademark as soon as possible. As it’s mostly ended up with squatters, counterfeiters, or grey market …

THE BRITISH VIRGIN ISLANDS COMPANIES

The British Virgin Islands (BVI) is one of the most popular places to create an international business company. Since it’s well-known as being a tax haven. Hence, BVI company registration is no doubt practical, making it one of the offshore tax havens. BVI is no corporate income tax, zero tax on capital gains, or value-added …

THE BUSINESS REGISTRATION FEE AND LEVY 2024-2025

2024-2025 the Business Registration Levy HK$220 will be waived per annum. While the registration fee will no longer be discounted. Starting from 1 April, 2024, the Business Registration fee is HK$2200. How much you have to pay in 2024-2025? Checking back, the calculating of 2023-2024, the amount of total business registration fee HK$2000, plus levy …

WHY IS IT SO EASY TO SETUP A BUSINESS IN HONG KONG?

Hong Kong is one of the top cities World-wide to set up businesses. Getting started is relatively quick and easy, setup costs are low and the overall environment encourages businesses to thrive. Centre O is here to assist and to facilitate businesses in both Hong Kong and China. Reasons for being relatively easy to set …

HOW TO CALCULATE PAID ANNUAL LEAVE?

Paid Annual Leave is part of the compensation Everyone knows there are 365 days in a year. Besides the weekend off, an employee does have annual leave. Also, paid annual leave is part of the compensation. Then what should an employer be aware of? Who can entitle a Paid-Leave? According to the Employment Ordinance, employees …

HONG KONG LIMITED OFFSHORE TAX EXEMPTION CLAIM

The territorial principle is the fundamental to the taxation of profit tax in Hong Kong. Thus, the profits which arise in or are derived from Hong Kong are liable to profits tax. Otherwise, you can claim of tax exemption on the ground of “Income not sourced in Hong Kong”. That is, may be treated as …