YOU NEED TO KNOW

OFFSHORE TAX EXEMPTION FOR HONG KONG LIMITED

offshore tax exemption in hong kong

BEST E-COMMERCE PLATFORMS FOR HONG KONG LIMITED COMPANIES

If you operate a Hong Kong limited company and want to establish or expand your online sales, selecting the right e-commerce platform is essential. Fortunately, numerous global and regional platforms welcome sellers from Hong Kong. Centre O is going to cover the best e-commerce platforms around the world that accept Hong Kong sellers, helping you pick the …

XERO UPDATE: GLOBAL PAY RUN RETIREMENT

Starting July 23, 2025, Xero will no longer allow users to create new pay runs in Global Pay Run. While you can still access and review past payroll records, processing new pay runs will no longer be possible. The feature will be fully retired in April 2026, so planning your transition to an alternative payroll solution is …

HONG KONG: HOW TO FILE THE EMPLOYER’S RETURN FORM (IR56)

In Hong Kong, employers must report their employees’ income to the Inland Revenue Department (IRD) using Employer’s Return Form ( IR56) each year around the end of April or early May. Here’s a simple step-by-step guide: 1. Obtain the Employer’s Return Form The Hong Kong Inland Revenue Departement (IRD) sends out the IR56B form every year in early …

HOW LITTLE RED BOOK IS TRANSFORMING CUSTOMER ENGAGEMENT IN HONG KONG

In the rapidly changing world of social commerce, Little Red Book (LRB) has become a revolutionary platform for businesses in Hong Kong. By seamlessly combining authentic user content, data-driven marketing, and streamlined shopping experiences, LRB provides a vibrant space for brands to connect with local audiences. Here’s a closer look at how LRB is reshaping …

Launch Your E-Commerce Business in Hong Kong

If you’re considering launching an e-commerce business, Hong Kong presents an optimal environment to kick off your venture. Recognized as one of Asia’s premier logistics hubs, the city offers significant advantages for online retailers. Its outstanding connectivity through air and sea transport allows for efficient movement of goods in and out of the region. Tax …

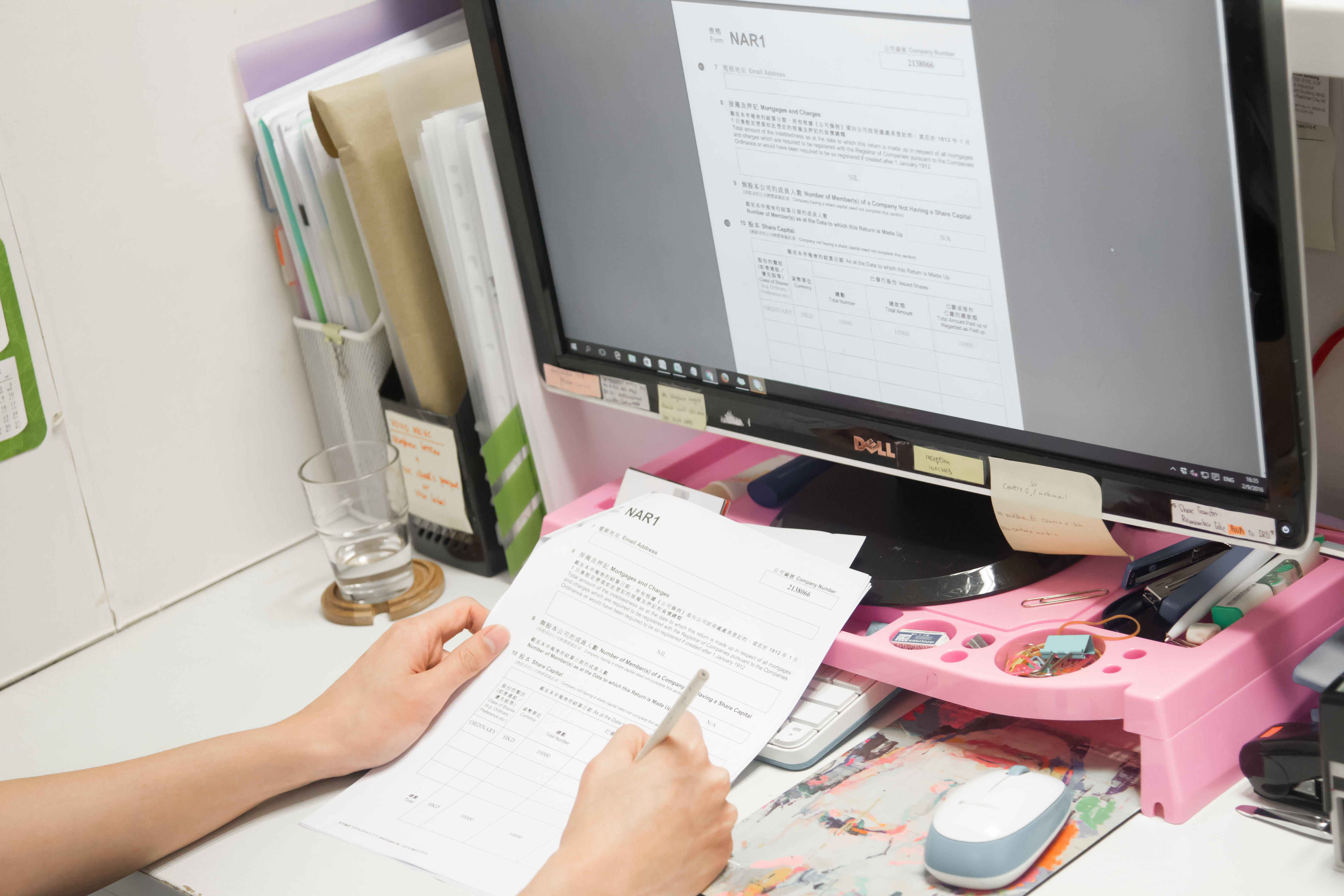

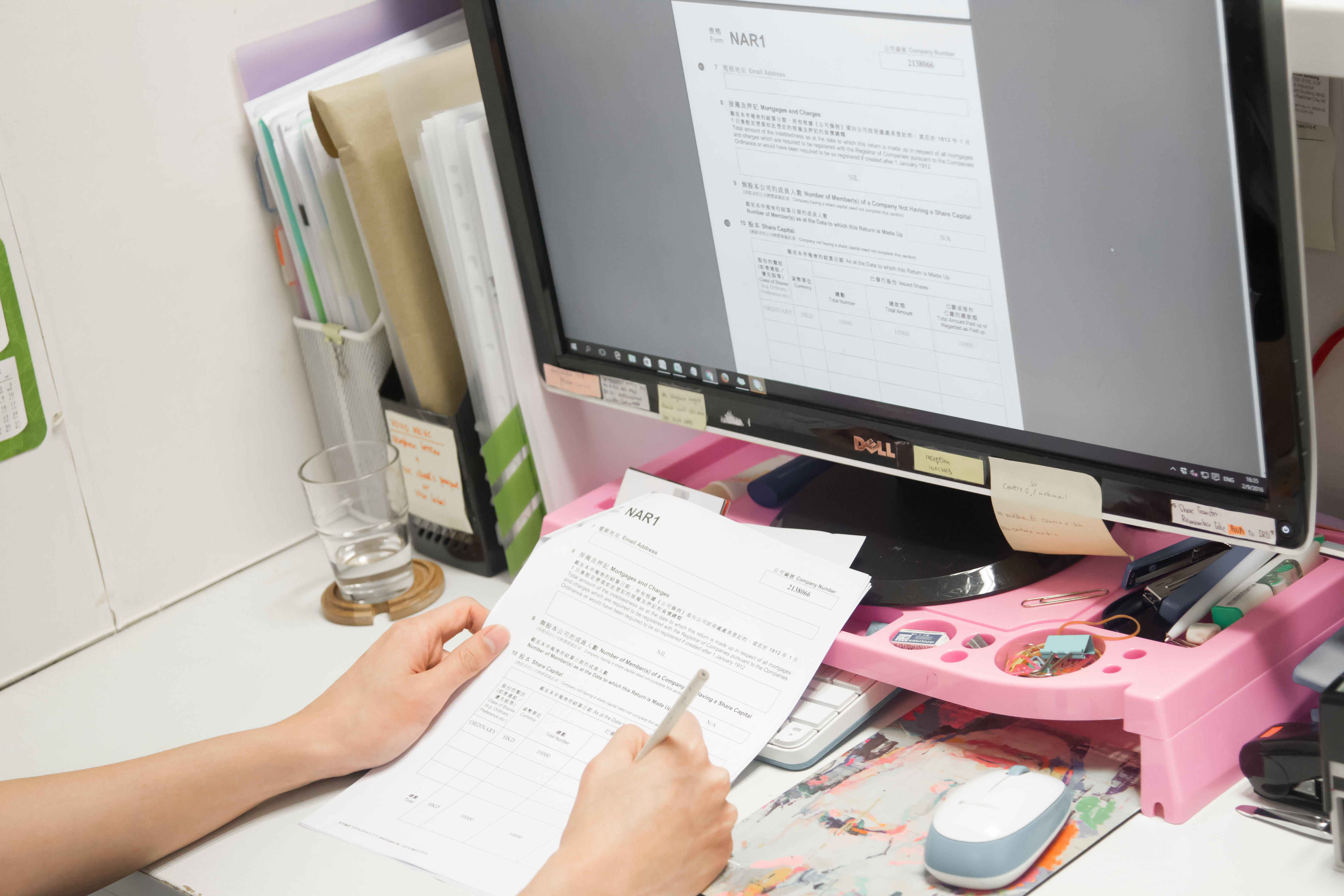

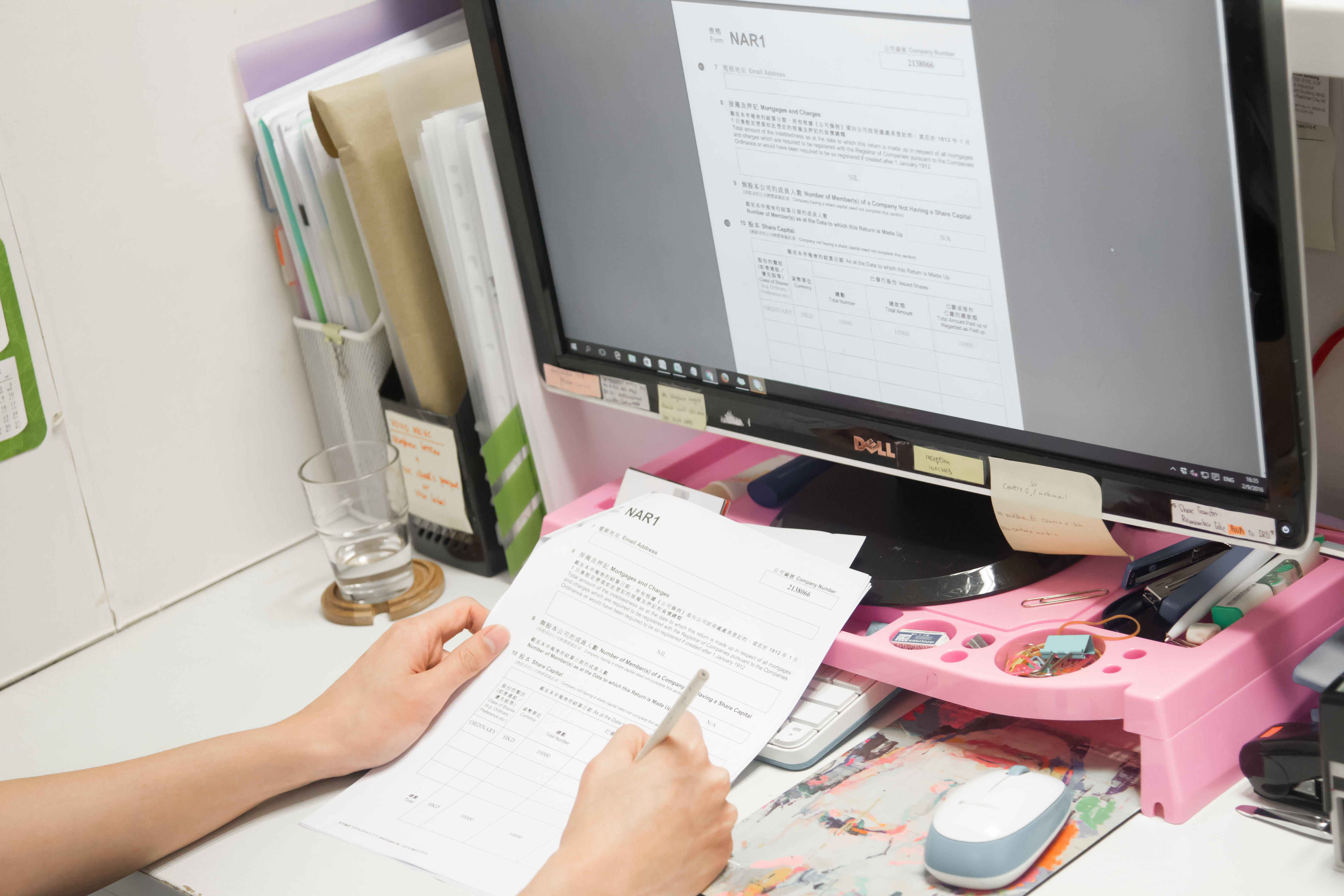

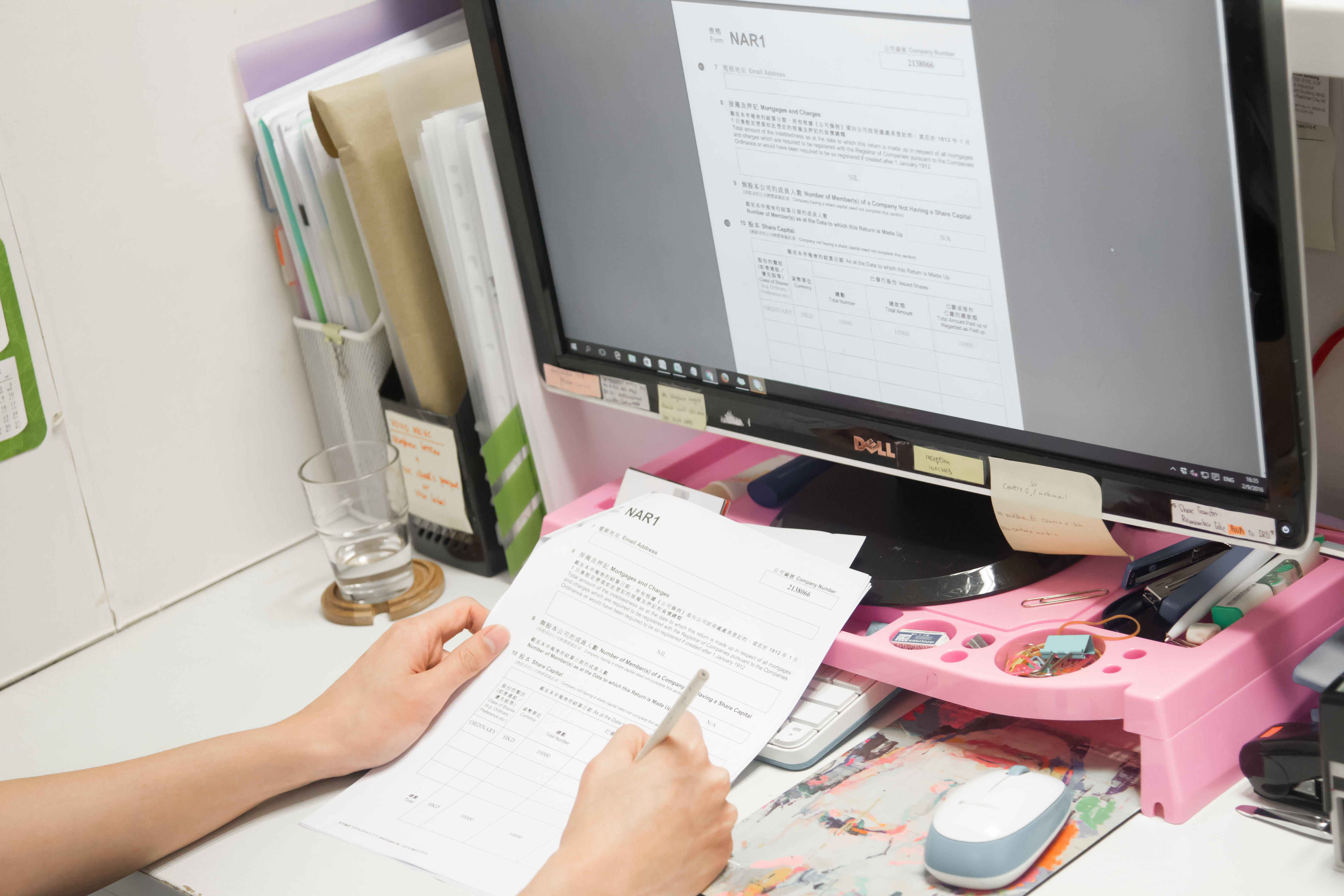

HONG KONG: LIMITED COMPANY SHARE STRUCTURE

When establishing a Hong Kong Limited Company, one critical factor to consider is the company’s share structure. Selecting the right directors and shareholders can not only facilitate business growth but also enhance governance stability and attract potential investors. If your business has multiple shareholders, drafting a comprehensive shareholder agreement is essential to prevent disputes in …

HONG KONG: OFFSHORE TAX REPORTING RULES

In the context of business operations, the term “offshore” often signifies advantages such as tax reductions; however, in Hong Kong, understanding offshore tax reporting is essential. The city operates under a territorial tax regime, meaning that only profits generated from Hong Kong sources are subject to Profits Tax. Thus, if you run a business in …

WHY XERO IS IDEAL FOR E-COMMERCE BUSINESSES

Xero, a leading cloud-based accounting software, is increasingly recognized for its robust features tailored specifically for e-commerce enterprises. Here’s a closer look at the key functionalities that make Xero an outstanding choice for online retailers. Seamless Integration with E-Commerce Platforms Xero integrates smoothly with platforms like Shopify, WooCommerce, BigCommerce, and Magento. This allows automatic syncing …

Starting an E-Commerce Business in Hong Kong: An Ideal Opportunity

Hong Kong stands out as an excellent location to launch an e-commerce venture. Renowned as one of the largest financial hubs globally, the city has long been a fertile ground for online businesses, even prior to the pandemic. With e-commerce sales projected to grow at a robust rate of 8.3% between 2022 and 2024, the …