WHAT IS THE PROFIT TAX RETURN (BIR51) FORM IN HONG KONG?

WHAT IS THE PROFIT TAX RETURN (BIR51) FORM IN HONG KONG?

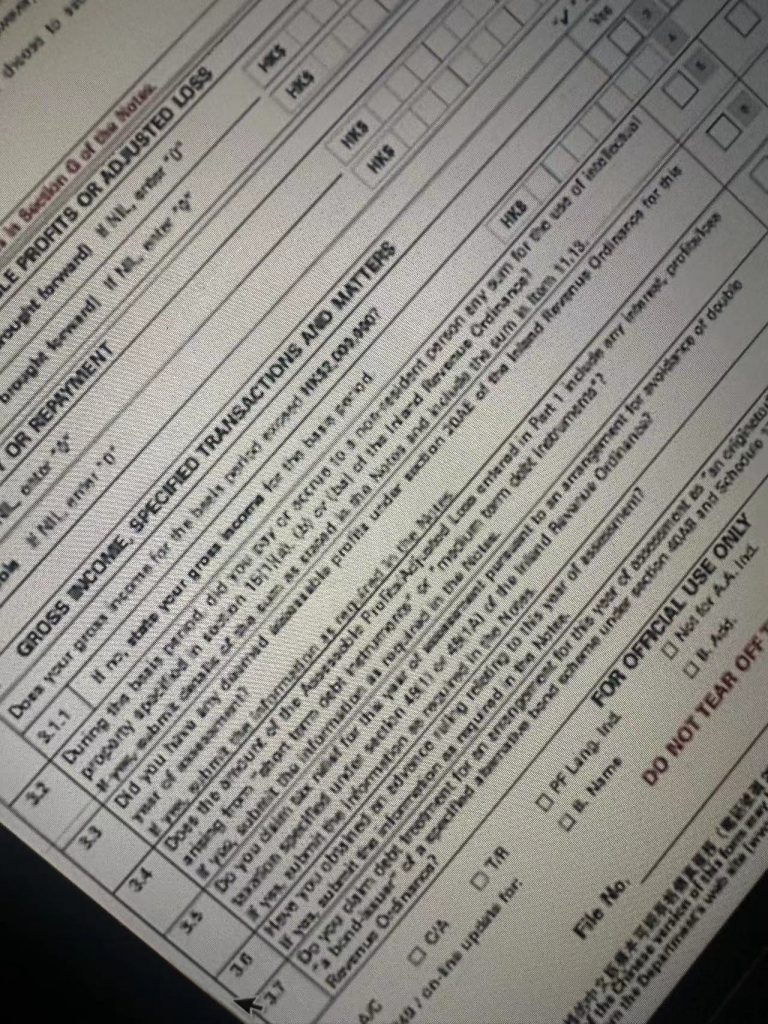

The Profit Tax Return Form is known as the “Profit Tax Return – Corporations (BIR51)”. BIR51 is used by corporations, including limited companies and other corporate entities. The purposes are to report their assessable profits and calculate the amount of profit tax payable to the Hong Kong Inland Revenue Department (IRD).

What information do you have to provide?

The BIR51 form not only requires details financial information about your company. For example, income, expenses, deductions, and tax liabilities for the relevant year. But also your corporation details such as postal address, contact number and principal business activity. If you have appointed an authorized representative. Then you have to fill in the form as well.

For the financial information, firstly, you have to state the accounting period, gross income and assessable profits. Secondly, you need to provide the details of deductible expenses, allowances and deductions claimed. And then fill in the computation of assessable profits and tax payable, including any tax credits or relief claimed.

Finally, you must sign the declaration of accuracy and completeness of the information provided. Please be aware any fault representation will cause heavy penalties.

When to submit the BIR51 Form?

You have to file your BIR51 within 1 month after the end of the company’s accounting period or depending on the company’s financial year-end date. For the startup, you can file within 3 months.

How to file the BIR51 form?

You can file your BIR51 paper form to the IRD’s office. Or you can file the form electronically via the IRD’s eTax portal.

Companies need to ensure accurate and timely completion of the profit tax return form to comply with Hong Kong’s tax laws and regulations and avoid penalties or legal consequences for non-compliance. Additionally, companies may seek professional advice from tax advisors or accountants to assist with the preparation and submission of their profit tax returns.

For further information, please contact us.

You may want to read: What to do when I receive a Profit Tax Return?